Understanding “New Car Out the Door Price”

New car out the door price – The “out-the-door” price of a new car represents the total cost you’ll pay to drive the vehicle off the dealership lot. This includes the sticker price, various fees, and taxes. Understanding this comprehensive price is crucial for making an informed purchase decision. It eliminates surprises and ensures transparency in the buying process.

Components of the Out-the-Door Price

The out-the-door price encompasses several key components. The most significant is the Manufacturer’s Suggested Retail Price (MSRP), which is the base price of the vehicle as set by the manufacturer. However, several additional fees are typically added, such as destination charges (covering transportation to the dealership), government fees (taxes, title, and registration), dealer preparation fees (covering pre-delivery inspection and detailing), and potentially additional options or packages selected by the buyer.

MSRP vs. Out-the-Door Price

The MSRP is merely the starting point. The out-the-door price represents the final, all-inclusive cost. The difference lies in the inclusion of various fees and taxes that are not reflected in the MSRP. Understanding this distinction is crucial to avoid unexpected costs at the dealership.

Hidden Fees Inflating the Final Price

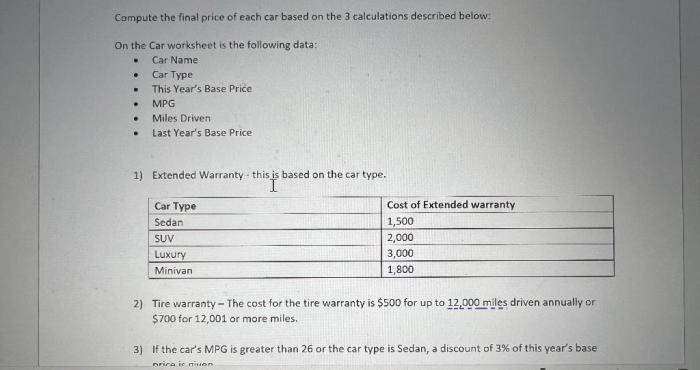

Several hidden fees can significantly inflate the final price. These may include extended warranties, paint protection, fabric protection, and dealer-installed accessories. It is essential to carefully review all charges before agreeing to the final price.

Typical Cost Breakdown Across Vehicle Classes

The following table provides a general comparison of cost breakdowns across different vehicle classes. Keep in mind that these are estimates and actual prices can vary significantly based on specific vehicle features, location, and dealer practices.

| Vehicle Class | MSRP | Average Additional Fees | Out-the-Door Price Estimate |

|---|---|---|---|

| Sedan | $25,000 | $2,500 | $27,500 |

| SUV | $35,000 | $3,000 | $38,000 |

| Truck | $45,000 | $3,500 | $48,500 |

Factors Influencing Out-the-Door Price

Several factors significantly impact the final out-the-door price of a new vehicle. Understanding these factors empowers buyers to make more informed decisions and potentially negotiate a better deal.

Impact of Vehicle Features and Options, New car out the door price

Source: cheggcdn.com

Adding features and options, such as sunroof, premium sound systems, advanced safety technologies, and leather interiors, directly increases the vehicle’s price. Each option adds to the MSRP, consequently affecting the final out-the-door price.

Dealership Location and Pricing

Dealerships in different geographic areas may have varying pricing strategies. Areas with higher demand or limited competition might have higher prices. Conversely, dealerships in competitive markets might offer lower prices to attract customers.

Manufacturer’s Pricing Strategy

Manufacturers employ different pricing strategies, influencing the MSRP and ultimately the out-the-door price. Some manufacturers focus on competitive pricing, while others position their vehicles as premium brands with higher price points. These strategies impact the overall cost to the consumer.

Comparison of Pricing Strategies Across Brands

Brands like Honda and Toyota are often known for their competitive pricing, while luxury brands like BMW and Mercedes-Benz command higher prices due to their brand image and features. This reflects the diverse pricing strategies adopted by different automotive manufacturers.

Negotiating the Out-the-Door Price

Negotiating the out-the-door price is a common practice. Effective negotiation requires preparation, research, and a clear understanding of the vehicle’s value and the dealer’s pricing strategies. A well-informed buyer can often secure a better deal.

Effective Negotiation Tactics

Effective negotiation tactics include researching comparable vehicle prices online, knowing your budget, being prepared to walk away, and focusing on the out-the-door price rather than negotiating individual components separately. This ensures transparency and prevents hidden costs from emerging later in the process.

Step-by-Step Guide to Negotiating a Lower Out-the-Door Price

- Research the vehicle’s fair market price.

- Determine your maximum budget.

- Visit multiple dealerships to compare prices.

- Negotiate the out-the-door price, not just the MSRP.

- Review all fees and charges carefully.

- Don’t be afraid to walk away if the deal isn’t favorable.

Examples of Successful Negotiation Strategies

One successful strategy is to leverage competing offers from other dealerships. Another is to negotiate based on the out-the-door price, which forces the dealer to be upfront about all costs. Finally, focusing on the total price, rather than individual components, prevents the dealer from adding extra charges during the final stages of negotiation.

Questions to Ask Before Finalizing the Purchase

Source: paternaldamnation.com

- What is the out-the-door price?

- What fees are included in the out-the-door price?

- What is the interest rate on financing?

- What is the total cost of ownership?

- What is the warranty coverage?

Financing and Out-the-Door Price

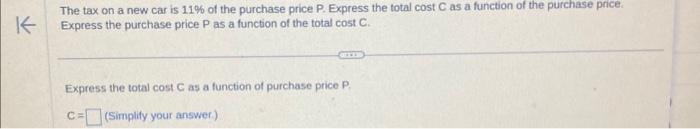

Financing options significantly influence the monthly payment and the overall cost of the vehicle. Understanding the implications of interest rates, loan terms, and different financing methods is essential for making an informed decision.

Impact of Financing Options on Monthly Payments and Total Cost

Longer loan terms result in lower monthly payments but higher overall interest paid. Conversely, shorter loan terms lead to higher monthly payments but lower total interest paid. The choice depends on individual financial circumstances and priorities.

Impact of Interest Rates and Loan Terms on the Final Price

Higher interest rates increase the total cost of the loan, while lower interest rates reduce the overall cost. Similarly, shorter loan terms reduce the total interest paid, but increase the monthly payment.

Comparison of Different Financing Options (Loans, Leases)

Loans involve borrowing the full purchase price and repaying it over a set period. Leases involve paying for the use of the vehicle over a shorter term, with a lower monthly payment but no ownership at the end of the lease. The best option depends on individual needs and financial situation.

Determining a new car’s out-the-door price often involves factoring in various fees beyond the sticker price. For luxury electric vehicles, this is especially true. To get a better idea of the costs involved, you might want to check the specifics for a particular model, such as the pricing details found on this site for the mercedes new electric car price.

Ultimately, understanding all the associated costs helps you budget effectively for your new car purchase, regardless of make or model.

Calculating the Total Cost of Ownership Considering Financing

To calculate the total cost of ownership, add the out-the-door price, financing charges (interest), insurance, registration, maintenance, and fuel costs over the ownership period. This provides a comprehensive understanding of the long-term financial commitment.

Additional Costs Beyond the Out-the-Door Price

Beyond the out-the-door price, several additional costs are associated with owning a new car. Understanding these expenses helps in budgeting effectively and avoids financial surprises after the purchase.

Common Post-Purchase Expenses

- Insurance premiums

- Registration fees

- Routine maintenance (oil changes, tire rotations)

- Fuel costs

Unexpected Expenses New Car Owners Might Encounter

- Unexpected repairs

- Parking tickets

- Tolls

- Increased insurance premiums due to accidents or violations

Extended Warranties and Their Associated Costs

Extended warranties offer additional coverage beyond the manufacturer’s warranty but come at an added cost. Carefully weigh the benefits and costs before purchasing an extended warranty.

Long-Term Cost Implications of Fuel Efficiency and Maintenance Schedules

Fuel-efficient vehicles reduce long-term fuel costs. Regular maintenance, as per the manufacturer’s schedule, helps prevent costly repairs and extends the vehicle’s lifespan. These factors contribute significantly to the overall cost of ownership.

Resources for Finding the Best Out-the-Door Price: New Car Out The Door Price

Several resources can help buyers find the best out-the-door price for a new car. Utilizing these resources empowers buyers to make informed decisions and secure the best possible deal.

Tips for Researching Vehicle Pricing Online

Source: cheggcdn.com

Utilize online resources like Kelley Blue Book (KBB), Edmunds, and TrueCar to research vehicle prices and compare them across different dealerships. These websites provide valuable data on MSRP, average transaction prices, and dealer incentives.

Value of Using Online Car-Buying Services

Online car-buying services often streamline the process, allowing buyers to compare prices, negotiate terms, and even complete the purchase online. These services can save time and potentially secure better deals.

Reputable Websites for Comparing Vehicle Prices

- Kelley Blue Book (KBB)

- Edmunds

- TrueCar

- Cars.com

- Autotrader

Checklist for Buyers to Ensure They Get the Best Possible Deal

- Research vehicle prices online.

- Visit multiple dealerships.

- Negotiate the out-the-door price.

- Compare financing options.

- Review all fees and charges carefully.

- Read the contract thoroughly before signing.

Question Bank

What does “dealer markup” mean?

Dealer markup refers to the amount a dealership adds to the MSRP of a vehicle, increasing the final price. This markup can vary significantly between dealerships.

How can I find the best interest rate on a car loan?

Shop around at multiple banks and credit unions, comparing interest rates and loan terms. Pre-approval for a loan can strengthen your negotiating position at the dealership.

What are common hidden fees I should watch out for?

Be wary of fees like dealer prep, window etching, and additional processing charges. Carefully review all paperwork before signing.

What is the difference between a lease and a loan?

A lease involves renting the car for a specific period, while a loan allows you to purchase the car outright. Leases typically have lower monthly payments but don’t lead to ownership.