New Car Invoice Price vs MSRP A Buyers Guide

Understanding Invoice Price and MSRP: New Car Invoice Price Vs Msrp

New car invoice price vs msrp – Navigating the world of new car purchases often involves deciphering seemingly complex pricing structures. Two key terms, the Manufacturer’s Suggested Retail Price (MSRP) and the invoice price, are central to this process. Understanding the difference between these two figures, and the factors influencing them, is crucial for securing a favorable deal.

Invoice Price and MSRP Differences

The MSRP is the price a manufacturer suggests retailers should sell a vehicle for. It’s a starting point, often inflated to provide negotiating room. The invoice price, on the other hand, represents the price the dealer pays the manufacturer for the vehicle. This price typically includes the manufacturer’s cost plus a small profit margin. The difference between these two figures represents the dealer’s potential profit margin.

Factors Influencing MSRP

Several factors contribute to a vehicle’s MSRP. These include manufacturing costs (labor, materials, and technology), features and options (premium sound systems, advanced safety features, etc.), market positioning (luxury versus economy), and brand reputation. Economic conditions, including inflation and material costs, also play a significant role.

Dealer Markup’s Impact on Final Sale Price

The dealer markup is the difference between the invoice price and the price the dealer offers to the consumer. Dealers often add a markup to the invoice price to increase their profit. This markup can vary significantly based on factors such as vehicle demand, dealer overhead, and negotiating skills of the buyer.

Invoice Price, MSRP, and Final Sale Price Comparison

| Car Model | Invoice Price | MSRP | Final Sale Price (Example) |

|---|---|---|---|

| Toyota Camry | $24,000 | $26,500 | $25,500 |

| Honda Civic | $21,000 | $23,000 | $22,000 |

| Ford Explorer | $35,000 | $39,000 | $37,000 |

Dealer Incentives and Rebates

Dealer incentives and manufacturer rebates significantly impact the final price of a new car, often offering substantial savings beyond simple negotiation. Understanding these programs is key to maximizing your purchasing power.

Common Dealer Incentives

Dealers frequently offer incentives to move inventory, such as financing deals (low interest rates or extended loan terms), trade-in allowances (higher value for your old car), and add-on packages (free accessories or maintenance plans). These incentives can directly reduce the final price or make the overall financing more attractive.

Manufacturer Rebates’ Influence

Source: cheggcdn.com

Manufacturer rebates are discounts offered directly by the car manufacturer to the consumer. These rebates are usually applied to the invoice price, effectively lowering the cost the dealer pays for the vehicle. This directly reduces the final price for the buyer.

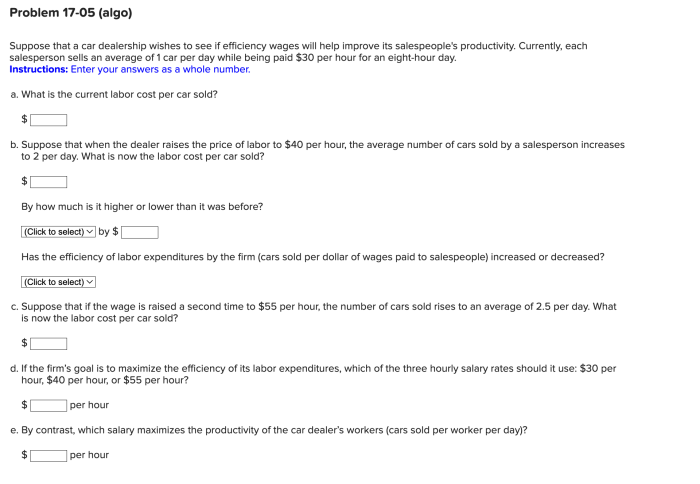

Rebates vs. Invoice Price Negotiation

In some cases, manufacturer rebates provide more significant savings than negotiating the invoice price. For instance, a large rebate might offset the dealer’s markup entirely, leading to a lower final price than what could be achieved through negotiation alone. The optimal strategy often involves combining negotiation with taking advantage of available rebates.

Scenario: Car Purchase With and Without Rebates

Let’s consider a hypothetical scenario: A car has an MSRP of $30,000 and an invoice price of $27,000. The dealer’s initial offer is $29,000. With a $2,000 manufacturer rebate, the final price drops to $27,000. Negotiating the invoice price without the rebate might only yield a $1,000 reduction, resulting in a final price of $28,000. The rebate, in this case, offers a better outcome.

Negotiating the Price

Effective negotiation is essential to securing a favorable price on a new car. By understanding common dealer tactics and employing strategic approaches, buyers can often achieve significant savings.

Effective Negotiation Strategies

Begin your negotiation with the invoice price as your target. Research the invoice price from reliable sources. Be prepared to walk away if the dealer is unwilling to negotiate reasonably. Highlight competing offers or better deals you’ve found elsewhere. Focus on the total out-the-door price, including fees and taxes, to avoid surprises.

Common Dealer Negotiation Tactics

Dealers might employ various tactics, such as highlighting the MSRP to make the offered price seem lower, focusing on monthly payments rather than the total price, or employing high-pressure sales techniques. Remaining calm, informed, and focused on your target price is crucial to counter these tactics.

Step-by-Step Negotiation Guide

- Research the invoice price and MSRP.

- Determine your maximum acceptable price.

- Start negotiations from the invoice price, aiming for a price slightly below it.

- Be prepared to walk away if the offer is unsatisfactory.

- Focus on the total out-the-door price.

- Document all agreements in writing.

Questions to Ask the Dealer

- What is the invoice price of the vehicle?

- What rebates or incentives are available?

- What are all the fees and charges included in the final price?

- What is your best price, including all fees?

- What is your financing offer?

Hidden Fees and Charges

Beyond the sticker price, several hidden fees can significantly inflate the final cost of a new car. Awareness of these fees and strategies to mitigate them is vital for budget-conscious buyers.

Common Hidden Fees

Common hidden fees include destination charges (fees for transporting the vehicle to the dealership), dealer prep fees (fees for minor detailing and inspections), documentary fees (administrative fees for processing paperwork), and extended warranties (often overpriced and unnecessary). Some dealerships might also add additional fees for things like nitrogen-filled tires or window etching.

Identifying and Avoiding Unnecessary Fees

Carefully review all paperwork before signing anything. Question any fees you don’t understand or deem excessive. Negotiate the fees, just as you negotiate the vehicle’s price. Consider comparing fees across different dealerships before committing to a purchase.

Fee Comparison Across Dealerships

Dealership practices regarding fees vary. Some dealerships might be more transparent and offer lower fees than others. Shopping around and comparing quotes from multiple dealerships can reveal significant differences in the overall cost, even if the vehicle price is similar.

Typical Hidden Fees and Their Impact

- Destination Charge: Adds several hundred dollars to the price.

- Dealer Prep Fee: Can range from a few hundred to over a thousand dollars.

- Documentary Fee: Typically a few hundred dollars.

- Extended Warranty: Can add thousands of dollars to the total cost.

Market Conditions and Their Impact

Market forces, including supply and demand, significantly influence both the invoice price and the MSRP of new cars. Understanding these dynamics is crucial for informed decision-making.

Market Demand’s Effect on Pricing

High demand for specific models or brands often leads to increased MSRP and higher dealer markups. Dealers can command higher prices when inventory is low and customer demand is high. Conversely, low demand may result in lower prices and potential dealer incentives to clear inventory.

Understanding the difference between a new car’s invoice price and its MSRP is crucial for smart buying. The sticker price is often inflated, so negotiating is key; however, knowing the invoice price gives you a solid baseline. For instance, when considering a high-performance vehicle like those listed on the new Audi sports car price page, this knowledge becomes even more valuable.

Ultimately, leveraging this price information allows you to better negotiate the final price of your new car, whether it’s an Audi or another brand.

Limited Supply and Price Increases

Supply chain disruptions or production limitations can lead to a limited supply of certain vehicle models. This scarcity directly contributes to higher prices, as demand exceeds supply. Popular models are particularly susceptible to this phenomenon.

Popular Models and Higher Markups

Highly sought-after models, such as electric vehicles or popular SUVs, frequently command higher markups due to strong consumer demand. Dealers know that these vehicles will sell quickly, allowing them to maintain higher profit margins.

Economic Conditions’ Impact

Economic downturns can lead to decreased demand and lower prices. Conversely, economic booms may increase demand and push prices upward. For example, during periods of high inflation, the cost of manufacturing vehicles increases, directly affecting the MSRP and, subsequently, the invoice price.

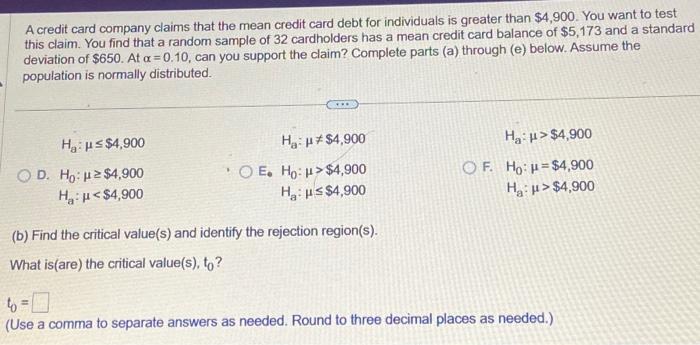

Resources for Finding Invoice Prices

Several online resources provide estimates of invoice prices for new cars. However, it’s crucial to understand the limitations and potential inaccuracies of these tools.

Reliable Online Resources

Websites like Edmunds, Kelley Blue Book (KBB), and TrueCar offer invoice price estimates. These resources use aggregated data from various sources to provide an approximation of the dealer’s cost. However, the accuracy can vary depending on the vehicle, model year, and specific options.

Accuracy and Features Comparison

The accuracy of these websites varies; some are more accurate for certain brands or models than others. Features such as detailed breakdowns of options and regional pricing differences also differ across these resources. Some may provide more comprehensive information on rebates and incentives.

Limitations of Online Resources

Source: cheggcdn.com

Invoice prices are not publicly available information, and the figures provided by online resources are estimates. The actual invoice price paid by a dealer might differ slightly from the online estimate due to various factors, including volume discounts and dealer-specific negotiations with the manufacturer.

Comparison of Online Invoice Price Resources, New car invoice price vs msrp

| Website | Accuracy | Features | Strengths | Weaknesses |

|---|---|---|---|---|

| Edmunds | High | Detailed specifications, rebate information | Comprehensive data, user-friendly interface | May not be perfectly accurate for all models |

| Kelley Blue Book (KBB) | Medium | Pricing tools, trade-in valuations | Widely recognized brand, user-friendly | Invoice price estimates might be less precise |

| TrueCar | Medium | Pricing information, dealer comparisons | Transparent pricing, connects buyers with dealers | Accuracy can vary depending on location and model |

Illustrative Example: Toyota Camry

Source: cheggcdn.com

Let’s consider a 2024 Toyota Camry LE. This example illustrates how MSRP, invoice price, and various factors contribute to the final sale price.

MSRP and Invoice Price

The MSRP for a 2024 Toyota Camry LE might be around $26,500, while the invoice price could be approximately $24,000. This represents a potential $2,500 dealer markup.

Potential Final Price Breakdown

- MSRP: $26,500

- Invoice Price: $24,000

- Dealer Markup (Example): $1,500

- Manufacturer Rebate (Example): $1,000

- Negotiated Price Reduction (Example): $500

- Destination Charge: $1,000

- Dealer Prep Fee: $500

- Taxes and Fees (Example): $1,500

- Final Price (Example): $26,000

Potential Dealer Markups

Dealer markups for popular models like the Camry can vary based on demand and dealer inventory. In high-demand situations, the markup might be closer to the full $2,500 difference between MSRP and invoice price. However, during periods of lower demand, the dealer might be willing to negotiate a lower markup.

Impact of Rebates and Incentives

Manufacturer rebates can significantly reduce the final price. For example, a $1,000 rebate would directly lower the final price by $1,000. Additional incentives, such as low-interest financing, can further enhance the overall value proposition.

FAQ Insights

What is a holdback?

A holdback is a percentage of the MSRP that the manufacturer retains and later pays to the dealer, often based on sales performance. It’s not directly part of the invoice price negotiation.

Can I always get a car for the invoice price?

While aiming for the invoice price is a reasonable goal, it’s not always achievable. High-demand vehicles or those with limited inventory may command higher markups.

What if the dealer won’t budge on price?

If negotiations stall, consider walking away. Dealers often reconsider their position when a potential sale is at risk. You can also explore different dealerships or wait for better market conditions.

How can I verify the accuracy of an online invoice price?

Cross-reference invoice prices from multiple reputable online sources. Discrepancies may indicate inaccuracies, so proceed with caution and further research.