Understanding Dealer Invoice Price

How to get dealer invoice price on new car – The dealer invoice price is a crucial figure in car negotiations. Understanding its components and how it differs from other pricing structures is the first step towards securing a favorable deal. This section will dissect the dealer invoice price, comparing it to the Manufacturer’s Suggested Retail Price (MSRP) and sticker price, and examining factors influencing its variation across brands and models.

Dealer Invoice Price Components

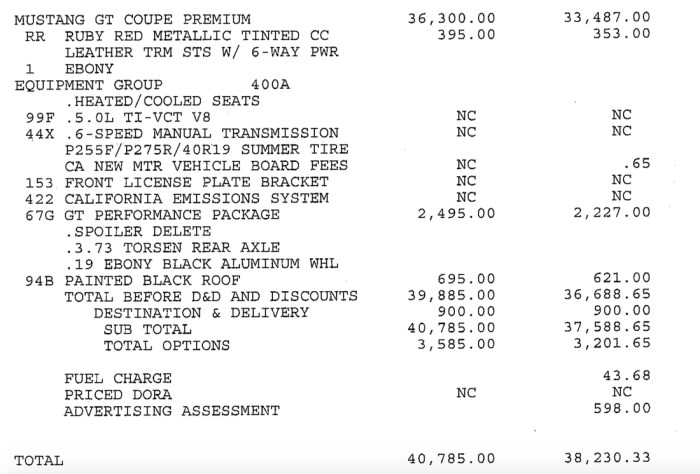

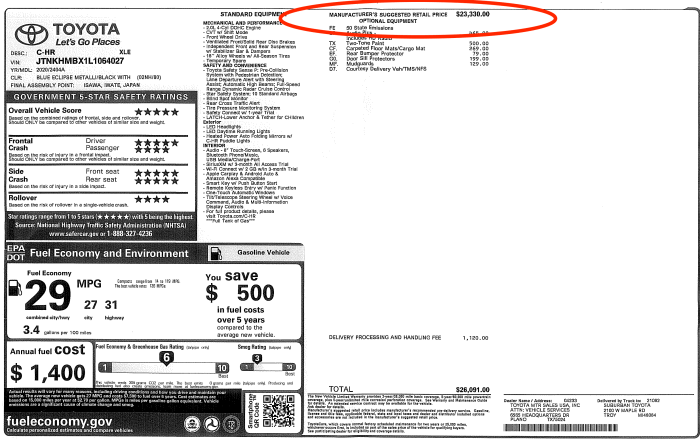

A dealer’s invoice price isn’t simply the price the dealership pays for the vehicle. It comprises several components: the base price of the vehicle, manufacturer incentives (rebates and discounts), destination charges (shipping costs from the factory), and any regional or dealer-specific adjustments. These elements fluctuate based on various market factors and manufacturer strategies.

Invoice Price vs. MSRP vs. Sticker Price

The Manufacturer’s Suggested Retail Price (MSRP) is the manufacturer’s recommended retail price, often found on the sticker. The sticker price includes the MSRP plus additional dealer-added options, packages, and destination charges. The invoice price, on the other hand, represents the price the dealership pays to the manufacturer, typically lower than both the MSRP and the sticker price. Understanding these differences empowers you to negotiate effectively.

Invoice Price Variations Across Brands and Models

Source: simpleinvoice17.net

Invoice prices vary significantly across different car brands and models. Luxury brands often have higher invoice prices than budget-friendly brands due to higher manufacturing costs and perceived value. Similarly, popular models in high demand may command higher invoice prices compared to less popular models. Factors like fuel efficiency, technological advancements, and safety features also influence the invoice price.

Factors Influencing Dealer Invoice Price

- Manufacturer Incentives: Rebates and discounts offered by the manufacturer to dealerships.

- Vehicle Demand: High demand for a specific model can inflate the invoice price.

- Production Costs: Changes in raw material costs and manufacturing processes affect the base price.

- Market Conditions: Economic factors, interest rates, and overall market trends influence pricing.

- Regional Differences: Location-specific factors can cause variations in invoice prices.

Methods to Obtain Invoice Price Information

Several methods exist for accessing dealer invoice pricing data. Each has varying degrees of reliability and accessibility. This section Artikels these methods, highlighting their strengths and weaknesses.

Accessing Dealer Invoice Pricing Data

Several resources provide invoice pricing information. These include subscription-based services, independent websites, and even some automotive publications. However, the accuracy and comprehensiveness of this information vary significantly. Free online resources often lack detail or accuracy.

Reliability of Different Methods

Subscription-based services generally offer the most reliable data due to their rigorous data collection and verification processes. Independent websites and free online resources can provide estimates, but these may not always be accurate or up-to-date. Always cross-reference information from multiple sources to verify its accuracy.

Negotiating a new car price often involves knowing the dealer’s invoice price; this gives you a strong starting point for discussions. To find comparable pricing for your research, check out the current fortuner car new model price information, which can help you gauge market value. Armed with this data, you can then confidently approach dealerships and aim for a price closer to the invoice cost.

Drawbacks of Free Online Resources

Free online resources often lack the detail and accuracy of paid services. They may contain outdated information, incomplete data, or inaccuracies. Furthermore, they may not cover all makes and models, limiting their usefulness. It’s crucial to exercise caution when relying on free online resources for critical financial decisions.

Comparison of Methods for Obtaining Invoice Price

| Source | Reliability | Cost | Access Method |

|---|---|---|---|

| Subscription-based services (e.g., Edmunds, Kelley Blue Book) | High | Paid subscription | Online access |

| Independent websites | Medium | Free or paid | Online access |

| Automotive publications | Medium | Subscription or purchase | Print or online |

| Dealership websites (rarely provide invoice pricing) | Low | Free | Online access |

Negotiating with Dealers Using Invoice Price: How To Get Dealer Invoice Price On New Car

Armed with the invoice price, you can approach negotiations with a strong foundation. This section details effective strategies for using the invoice price as a benchmark during your car purchase negotiations.

Effective Negotiation Strategies

Using the invoice price as a starting point allows for a transparent and data-driven negotiation. Present the invoice price as your target, leaving room for minor adjustments. Focus on the total price, including taxes, fees, and financing, rather than just the vehicle’s price. Prepare to walk away if the dealer is unwilling to negotiate reasonably.

Presenting the Invoice Price

Present the invoice price calmly and confidently, emphasizing that it represents the dealer’s cost. Avoid aggressive tactics; instead, focus on a collaborative approach. Highlight your research and willingness to walk away if a fair deal cannot be reached. This shows you’re informed and serious about your purchase.

Addressing Dealer Counterarguments

Dealers may counter with arguments about market adjustments, holdback (manufacturer’s profit margin), and advertising costs. Be prepared to address these points by emphasizing the invoice price as a fair starting point and highlighting the overall deal’s competitiveness. Remember to remain polite and professional throughout the negotiation.

Step-by-Step Negotiation Guide

- Research the invoice price using reliable sources.

- Visit dealerships prepared to negotiate.

- Present the invoice price as your target price.

- Listen to the dealer’s counterarguments and address them logically.

- Negotiate on the total price, including fees and financing.

- Be prepared to walk away if the deal isn’t favorable.

- Review all documents carefully before signing.

Factors Affecting Negotiation Success

Several factors influence your success in negotiating a car price. Understanding these factors empowers you to optimize your negotiation strategy and increase your chances of securing a favorable deal.

Factors Impacting Negotiation Success

- Timing and Market Conditions: Negotiating during slow sales periods or when the dealer is trying to meet sales quotas can be advantageous. Conversely, high demand periods may limit your negotiation leverage.

- Credit Score: A higher credit score qualifies you for better financing rates, which can significantly impact the overall cost of the vehicle.

- Trade-in Value: A higher trade-in value reduces your out-of-pocket expenses, strengthening your negotiating position.

- Your Negotiation Skills: Confidence, preparation, and a willingness to walk away are crucial negotiation skills.

- Dealer Reputation: Researching the dealer’s reputation for fair pricing and customer service can influence your negotiation strategy.

Alternatives to Invoice Price Negotiation

While the invoice price is a valuable benchmark, alternative negotiation strategies can be employed. This section explores these strategies and compares them to invoice-based negotiation.

Alternative Negotiation Strategies

- Focusing on the Out-the-Door Price: Negotiating the total price, including all fees and taxes, simplifies the process and avoids haggling over individual components.

- Comparing Offers from Multiple Dealerships: Obtaining quotes from multiple dealerships creates competition and can lead to better deals.

- Negotiating Financing Separately: Securing favorable financing terms independently can reduce the overall cost, even if the vehicle price isn’t significantly lowered.

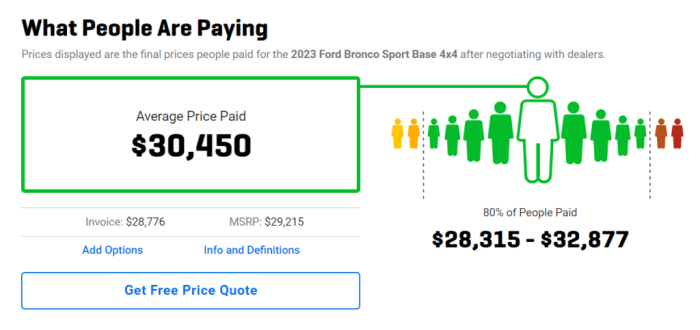

Comparing Negotiation Strategies, How to get dealer invoice price on new car

Source: yourcarbuyingadvocate.com

Invoice-based negotiation provides a clear benchmark, while other strategies focus on the overall cost or leveraging competition. Combining strategies often yields the best results. For example, you might use the invoice price as a starting point, then compare offers from multiple dealerships, ultimately negotiating the best out-the-door price.

Illustrating Negotiation Scenarios

Let’s examine successful and unsuccessful car price negotiation scenarios to highlight the impact of different communication styles and strategies.

Successful and Unsuccessful Negotiation Scenarios

Scenario 1 (Successful): A well-prepared buyer presents the invoice price, calmly discusses market conditions, and negotiates a deal slightly above invoice, securing favorable financing. The buyer maintains a professional and respectful demeanor, using confident body language. Scenario 2 (Unsuccessful): An unprepared buyer lacks knowledge of the invoice price and accepts the sticker price without negotiation. The buyer displays hesitant body language and readily agrees to the dealer’s terms.

Summary of Negotiation Scenarios

Source: squidex.io

| Scenario | Outcome | Negotiation Strategy | Key Factors |

|---|---|---|---|

| Scenario 1 (Successful) | Price slightly above invoice, favorable financing | Invoice price as benchmark, confident negotiation, focus on total price | Preparation, confident communication, understanding of market conditions |

| Scenario 2 (Unsuccessful) | Sticker price accepted | Lack of preparation, no negotiation | Lack of knowledge, hesitant communication, no alternative strategies |

Popular Questions

Can I get the exact dealer invoice price?

While you might not get the precise figure, you can get a very close estimate using various online resources and research. Dealers are generally reluctant to disclose the exact invoice price.

What if the dealer refuses to budge from their price?

Be prepared to walk away. Having done your research and knowing your alternatives strengthens your negotiating position. A firm stance and willingness to leave can often lead to a better offer.

How important is my credit score in negotiations?

A good credit score significantly impacts your financing options and can influence the dealer’s willingness to negotiate. A higher score often translates to better interest rates and more favorable terms.

What’s the best time of year to buy a car?

The end of the month and the end of the quarter are typically good times to negotiate, as dealers are often motivated to meet sales quotas.