How to Find Out New Car Invoice Price

Understanding the Car Invoice Price

How to find out new car invoice price – The invoice price is the price a dealership pays the manufacturer for a vehicle. Understanding this price is crucial for effective car buying negotiations. This section will break down the components of the invoice price, compare it to other pricing models, and provide examples of how manufacturer incentives influence it.

Components of the Car Invoice Price

The invoice price isn’t simply the sticker price minus a fixed percentage. It’s a more complex figure, encompassing the base vehicle price, the cost of any optional features or packages, and dealer holdback. Dealer holdback is a percentage of the MSRP that the manufacturer keeps in reserve for the dealer, essentially a profit margin built into the invoice price itself.

Additionally, regional adjustments and destination charges are included. These charges cover the cost of shipping the vehicle to the dealership.

Invoice Price, MSRP, and Sticker Price Differences

The MSRP (Manufacturer’s Suggested Retail Price) is the price the manufacturer recommends the dealer sell the vehicle for. The sticker price, displayed prominently on the vehicle, often includes additional dealer markup beyond the MSRP. The invoice price, however, is the wholesale price paid by the dealership, typically significantly lower than both the MSRP and the sticker price.

Manufacturer Incentives Affecting Invoice Price

Manufacturers frequently offer incentives to dealerships, which can directly impact the invoice price. These incentives might include rebates for selling a certain number of vehicles, marketing allowances, or end-of-year sales promotions. These incentives effectively lower the dealership’s cost, potentially leading to better deals for buyers.

Comparison of Invoice Price, MSRP, and Sticker Price

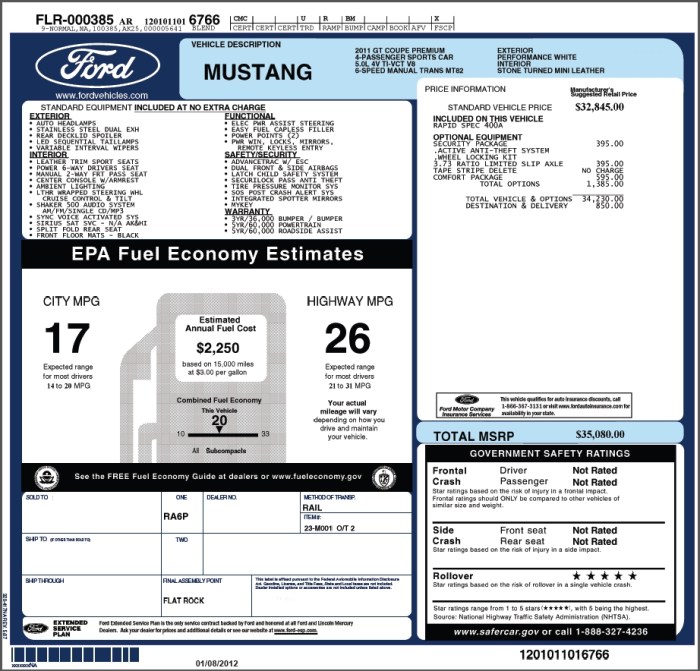

Source: simpleinvoice17.net

The following table illustrates the differences between invoice price, MSRP, and sticker price for three different car models. These figures are illustrative and may vary based on specific options and regional factors.

| Car Model | Invoice Price | MSRP | Sticker Price |

|---|---|---|---|

| Sedan A | $22,000 | $25,000 | $27,000 |

| SUV B | $30,000 | $35,000 | $38,000 |

| Truck C | $40,000 | $45,000 | $48,000 |

Online Resources for Finding Invoice Prices

Several reputable online resources provide estimates of car invoice prices. While not always perfectly accurate due to the dynamic nature of pricing and incentives, these tools can be invaluable in your car-buying journey. This section will review several popular options and discuss their strengths and weaknesses.

Reputable Websites for Invoice Price Information

Websites like Edmunds, Kelley Blue Book (KBB), and TrueCar offer invoice price estimates. Each website utilizes different methodologies and data sources, resulting in variations in the estimated invoice prices. It’s recommended to consult multiple sources for a comprehensive view.

Comparison of Online Tools

The accuracy and features of online invoice price tools vary. Some offer more detailed breakdowns of pricing components, while others may focus solely on a final estimated invoice price. Consider the level of detail needed when selecting a resource.

| Website | Accuracy | Features | Pros | Cons |

|---|---|---|---|---|

| Edmunds | High | Detailed price breakdowns, reviews | Comprehensive data, user-friendly interface | May not always reflect current incentives |

| Kelley Blue Book (KBB) | Medium | Fair market value estimates, pricing tools | Widely recognized brand, easy to use | Less detailed invoice price information |

| TrueCar | Medium | Price comparisons, dealer connections | Connects buyers with dealers | Focuses more on market price than invoice |

Dealer-Specific Information

While online resources provide estimates, obtaining the actual invoice price from a dealership can be challenging. Dealerships may be reluctant to disclose this information, employing various tactics to obscure it. However, with a polite and informed approach, it’s possible to gain valuable insights.

Negotiating with Dealers Using Invoice Price Information

Armed with invoice price information, you can negotiate from a position of strength. Starting your negotiation close to the invoice price, rather than the MSRP or sticker price, significantly increases your chances of securing a favorable deal. Be prepared to walk away if the dealer is unwilling to negotiate reasonably.

Challenges in Obtaining the Actual Invoice Price

Dealers often try to avoid disclosing the invoice price by citing various reasons, including the argument that it’s confidential information or that their pricing is already competitive. They may also try to distract you with other aspects of the deal, like financing options or extended warranties.

How Dealers Obscure Invoice Price

Dealers may use vague or misleading terms, present inflated “market adjustments,” or claim that their pricing is already at or below invoice. They might also emphasize the value of added features or packages, diverting attention from the base vehicle price.

Step-by-Step Guide to Requesting Invoice Price Information

- Be polite and respectful in your communication.

- Clearly state your intention to purchase the vehicle.

- Explain that you’ve researched the vehicle’s invoice price and would like to use it as a basis for negotiation.

- Be prepared to provide evidence of your research from reputable online sources.

- If the dealer is unwilling to disclose the invoice price, consider walking away and exploring other dealerships.

Factors Influencing Invoice Price: How To Find Out New Car Invoice Price

Several factors beyond the base vehicle price influence the invoice price. Understanding these factors provides a more complete picture of the pricing dynamics and can help you anticipate potential variations.

Impact of Car Options and Features

Additional options and features directly increase the invoice price. A vehicle with premium sound systems, advanced safety features, or luxury packages will have a higher invoice price compared to a base model. Each option adds to the manufacturer’s cost, ultimately reflected in the invoice price.

Dealership Location and Market Conditions

The dealership’s location and prevailing market conditions can influence the invoice price. Dealerships in high-demand areas or those selling popular models might have higher invoice prices due to increased competition and market pressure. Conversely, dealerships in areas with lower demand may have slightly lower invoice prices.

Influence of Time of Year

Seasonal factors play a role. Dealerships often experience higher demand during certain times of the year, such as the start of a new model year or during major sales events. This increased demand can lead to higher invoice prices, or conversely, end-of-year sales may lower them.

External Factors Influencing Invoice Price

- Manufacturer incentives and rebates

- Fuel prices (affecting demand for fuel-efficient vehicles)

- Economic conditions (affecting consumer spending)

- Interest rates (affecting financing costs)

- Supply chain issues (affecting vehicle availability)

Using Invoice Price for Negotiation

Effective negotiation requires using the invoice price as a strategic starting point. This section will Artikel strategies and techniques for leveraging invoice price information during negotiations.

Using Invoice Price as a Negotiation Starting Point

Begin your negotiations by stating your willingness to pay a price slightly above the invoice price, emphasizing your research and understanding of the vehicle’s true cost. This approach establishes a reasonable and informed starting point for the negotiation.

Successful Negotiation Strategies

Successful negotiation often involves a combination of strategies. This includes being prepared to walk away, knowing your limits, and remaining calm and professional. Highlighting the value proposition of the vehicle and comparing prices from other dealerships can also strengthen your position.

Maintaining a Professional Demeanor

Maintain a respectful and professional attitude throughout the negotiation process. Avoid aggressive tactics or confrontational language. A calm and confident approach is more likely to yield positive results.

Flowchart Illustrating the Negotiation Process

The following flowchart provides a simplified visual representation of a negotiation process using the invoice price as a reference.

(Illustrative flowchart description: Start -> Research Invoice Price -> Visit Dealership -> Present Offer (Slightly above Invoice) -> Dealer Counteroffer -> Negotiate -> Agreement or Walk Away -> End)

Illustrative Examples

Real-world scenarios highlight the importance of knowing the invoice price. This section will present examples of successful and unsuccessful negotiations, emphasizing the financial implications of invoice price knowledge.

Successful Negotiation Scenario

Imagine a buyer who researched the invoice price of a specific car model and found it to be $25,000. They went to the dealership prepared to offer $26,000. After some negotiation, they secured the vehicle for $26,500, saving several thousand dollars compared to the sticker price of $30,000.

Unsuccessful Negotiation Scenario

Source: simpleinvoice17.net

In contrast, consider a buyer who went to the dealership without any prior knowledge of the invoice price. They ended up paying the sticker price, unaware that they could have negotiated a significantly lower price had they known the invoice price.

Financial Implications of Not Knowing Invoice Price

Source: vencru.com

Not knowing the invoice price can lead to overpaying for a vehicle. This can result in significant financial losses over the lifetime of the loan, particularly with higher interest rates.

Narrative of a Successful Negotiation, How to find out new car invoice price

Sarah, armed with invoice price information from Edmunds, visited a dealership to buy a new SUV. She politely informed the salesperson of her research and presented an offer slightly above the invoice price. After a brief, respectful negotiation, Sarah secured the vehicle at a price considerably below the sticker price, saving several thousand dollars. Her preparation and knowledge of the invoice price ensured a successful outcome.

Popular Questions

What if the dealer refuses to disclose the invoice price?

While dealers aren’t obligated to reveal their invoice price, politely reiterate your desire for transparency and your intention to shop around. Their reluctance may indicate a less-than-favorable deal.

How often do invoice prices change?

Discovering a new car’s invoice price often involves contacting dealerships directly or using online resources. To get a clearer picture of potential savings, understanding the manufacturer’s suggested retail price is key; for Honda, you can check out the pricing details at honda brand new car price to compare against invoice prices you’ve obtained. Ultimately, comparing various sources helps you negotiate effectively when buying a new vehicle.

Invoice prices can fluctuate due to manufacturer incentives, market demand, and other factors. It’s best to check prices shortly before you intend to purchase.

Are there any hidden fees I should be aware of?

Yes, be sure to carefully review all documentation for additional fees such as destination charges, dealer fees, and document preparation fees. These can add significantly to the final price.

Can I use the invoice price to negotiate a lease?

While less common, you can still use the invoice price as a reference point when negotiating a lease, focusing on the residual value and monthly payments.