How to Find Out Invoice Price on New Car

Understanding Invoice Price Components

Source: yourcarbuyingadvocate.com

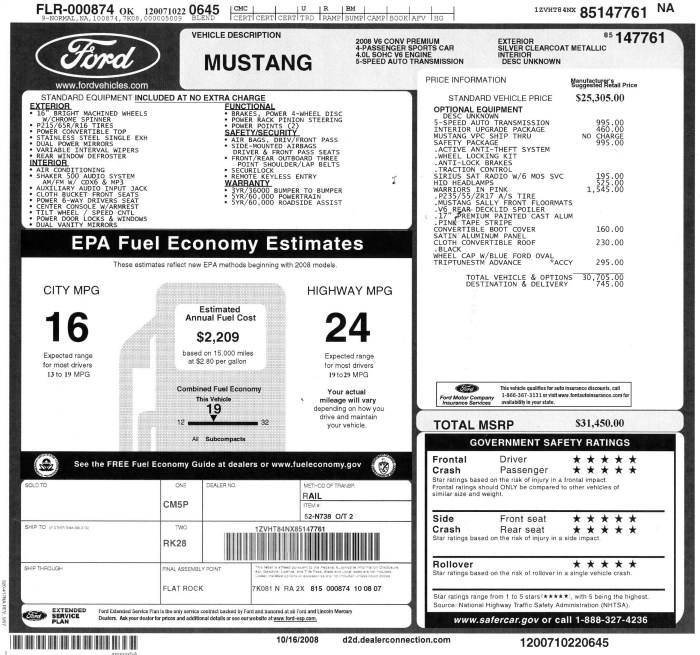

How to find out invoice price on new car – The invoice price of a new car is the price the dealership pays the manufacturer. Understanding this price is crucial for effective negotiation. It differs significantly from the sticker price (MSRP) and represents a more realistic starting point for price discussions.

Sticker Price vs. Invoice Price

The sticker price, or Manufacturer’s Suggested Retail Price (MSRP), is the suggested retail price set by the manufacturer. It’s often significantly higher than the invoice price, reflecting the manufacturer’s intended profit margin and leaving room for dealer negotiation. The invoice price, on the other hand, is the price the dealership pays to the manufacturer, excluding any additional fees.

Invoice Price Components, How to find out invoice price on new car

Source: vencru.com

The invoice price isn’t simply the cost of the vehicle itself. Several fees are typically included. These can vary slightly by manufacturer and region, but common components include destination charges (covering transportation to the dealership), dealer fees (administrative or processing fees), and sometimes additional manufacturer incentives or rebates.

MSRP and Invoice Price Relationship

The MSRP is generally higher than the invoice price. The difference represents the dealer’s potential profit margin. This margin can fluctuate based on factors such as vehicle demand, available incentives, and the dealer’s own pricing strategies. A higher-demand vehicle might have a smaller difference between MSRP and invoice price, while a less popular model might offer a larger potential discount.

Price Comparison Table

| MSRP | Invoice Price (Estimate) | Dealer Fees | Out-the-Door Price (Estimate) |

|---|---|---|---|

| $35,000 | $32,000 | $700 | $32,700 (assuming successful negotiation near invoice) |

| $28,000 | $25,500 | $500 | $26,000 (assuming successful negotiation near invoice) |

| $42,000 | $39,000 | $800 | $39,800 (assuming successful negotiation near invoice) |

Accessing Dealer Invoice Information

Source: simpleinvoice17.net

While obtaining the exact dealer invoice is challenging, several methods offer unofficial estimates. These estimates provide a valuable benchmark for negotiations, although inaccuracies are possible.

Online Resources for Invoice Price Estimation

Numerous websites and online tools provide estimated invoice prices. These tools often use algorithms and aggregated data to generate approximations based on vehicle model, trim level, and location. However, it’s important to understand their limitations.

Limitations of Online Estimates

Online invoice price estimates should be considered approximations, not precise figures. Actual invoice prices can vary due to regional differences, dealer-specific negotiations with the manufacturer, and time-sensitive incentives. These estimates provide a general range, not a guaranteed price.

Comparison of Online Tools

| Tool | Pros | Cons | Accuracy (General) |

|---|---|---|---|

| Example Tool A | Easy to use, widely available data | May not reflect current incentives, regional variations | +/- $500 |

| Example Tool B | Detailed information, includes regional adjustments | Requires registration, less user-friendly interface | +/- $300 |

| Example Tool C | Free, simple interface | Limited data, less accurate for newer models | +/- $1000 |

Negotiating the Price

Using the estimated invoice price as a starting point significantly strengthens your negotiating position. A step-by-step approach ensures a more effective and confident negotiation.

Negotiation Steps Using Invoice Price

- Research the invoice price using online tools.

- Visit dealerships prepared with your research.

- Present the invoice price as your target price, emphasizing your research.

- Negotiate from this starting point, highlighting any additional incentives or rebates.

- Don’t be afraid to walk away if the deal isn’t favorable.

Handling Dealer Pushback

Dealers might attempt to justify higher prices by emphasizing MSRP or highlighting additional fees. Remain firm in your position, referencing your research and emphasizing the invoice price as a realistic benchmark. Be prepared to walk away if the dealer is unwilling to negotiate reasonably.

Common Dealer Tactics and Counter-Strategies

- Tactic: Claiming the invoice price is confidential. Counter-strategy: Refer to your online research and state your understanding of the general price range.

- Tactic: Highlighting additional fees not included in the invoice price. Counter-strategy: Negotiate these fees individually, aiming for a reduction.

- Tactic: Pressuring you to make a quick decision. Counter-strategy: Take your time, and don’t feel pressured into an unfavorable deal.

Alternative Approaches to Finding Invoice Price

While online tools offer estimates, alternative approaches can provide additional insight, though they may require more effort and direct interaction with dealerships.

Alternative Information Sources

Contacting other dealerships in your area to compare prices can offer a broader perspective on pricing trends. While they may not disclose their exact invoice price, comparing their offered prices provides valuable context.

Approaching Dealerships Directly

While unlikely to yield the precise invoice price, a direct approach can provide insights into the dealer’s pricing structure. Focus on transparency and emphasize your intention to purchase. Politely inquire about their pricing policies and any current incentives.

Ethical Considerations

Using invoice price information ethically involves transparency and fair negotiation. Avoid deceptive tactics or misrepresenting your intentions. Remember that the dealer also needs to make a profit; aim for a mutually beneficial agreement.

Flowchart for Direct Dealer Inquiry

A visual flowchart outlining steps to obtain information directly from a dealer would be beneficial here. However, a textual representation follows below:

- Contact the dealership’s sales manager.

- Politely inquire about their pricing structure for the specific vehicle.

- If they are unwilling to disclose the invoice price, politely inquire about their best price.

- Compare their offer with online estimates and other dealerships.

- Negotiate based on the information gathered.

Illustrative Examples of Invoice Price Scenarios

Real-world scenarios demonstrate how various factors influence the final negotiated price relative to the invoice price.

Scenario Examples

- Vehicle: Popular SUV, MSRP: $40,000, Estimated Invoice: $37, Due to high demand, the dealer was less willing to negotiate below $38,

500. Final Negotiated Price

$38,500. This scenario shows a smaller discount due to high demand.

- Vehicle: Less popular sedan, MSRP: $25,000, Estimated Invoice: $22,

500. The dealer offered a significant discount due to lower demand and end-of-year incentives. Final Negotiated Price

$23,000. This demonstrates a larger discount due to lower demand.

- Vehicle: New model with manufacturer rebates, MSRP: $32,000, Estimated Invoice: $29,000, Manufacturer Rebate: $1,

000. The dealer was willing to negotiate near the invoice price due to the rebate. Final Negotiated Price

$28,500. This highlights the impact of manufacturer incentives.

FAQ Resource: How To Find Out Invoice Price On New Car

What happens if the dealer refuses to disclose the invoice price?

While dealers aren’t obligated to disclose their invoice price, you can still negotiate effectively by using online estimates and focusing on the out-the-door price. Be prepared to walk away if the dealer is unwilling to compromise.

Determining a new car’s invoice price can be tricky, often requiring research across multiple dealerships. However, a good starting point is to obtain a free new car price quote, which you can easily get by visiting this helpful website: free new car price quote. Using this quote as a benchmark, you can then compare it against invoice prices found through independent automotive pricing guides to negotiate a better deal.

Are there any legal requirements regarding invoice price disclosure?

There are no federal laws mandating dealer invoice price disclosure. However, some states may have regulations regarding transparency in car pricing.

How often do invoice prices change?

Invoice prices can change frequently due to manufacturer incentives, market demand, and other factors. It’s best to obtain the most up-to-date estimate before starting negotiations.

Can I use the invoice price as the sole basis for negotiation?

While the invoice price is a valuable starting point, other factors like market conditions, vehicle demand, and dealer incentives should also be considered during negotiations.