Find New Car Invoice Price A Buyers Guide

Understanding Invoice Prices

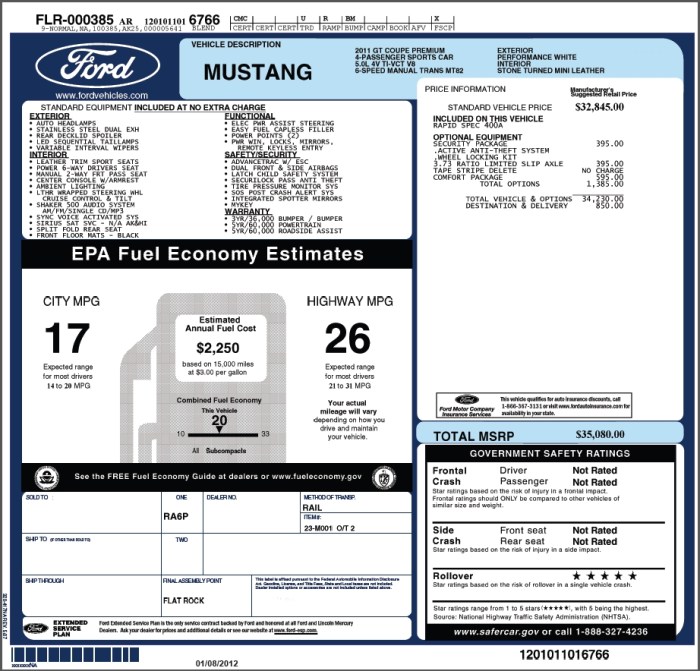

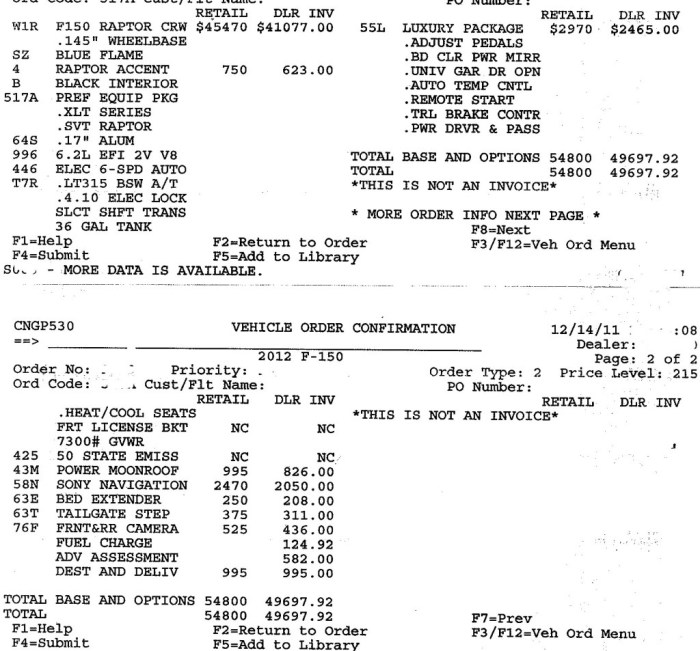

Find new car invoice price – Negotiating a car purchase effectively hinges on understanding the various price points involved. This section clarifies the differences between MSRP, invoice price, and dealer invoice price, exploring the factors that influence these figures and highlighting potential hidden costs.

MSRP, Invoice Price, and Dealer Invoice Price

The Manufacturer’s Suggested Retail Price (MSRP) is the price the manufacturer recommends for the vehicle. The invoice price represents the price the dealer supposedly pays the manufacturer for the car. The dealer invoice price, however, can be slightly different and often includes additional fees and adjustments not reflected in the standard invoice price. The gap between these prices provides the dealer’s profit margin.

Factors Influencing Invoice Price

Several factors contribute to a car’s invoice price. These include the vehicle’s model and trim level, the manufacturer’s production costs, market demand, and any current incentives or rebates offered by the manufacturer. For example, a high-demand vehicle in short supply will likely have a higher invoice price than a less popular model.

Hidden Fees Impacting Final Price

Beware of hidden fees that can significantly inflate the final price. These can include dealer preparation fees, documentation fees, advertising fees, and others. These fees can vary widely between dealerships and are not always transparently disclosed upfront. For instance, a seemingly small $500 dealer preparation fee can easily push the final price beyond the negotiated amount.

Finding a new car’s invoice price can be tricky, requiring research across various dealerships. However, understanding the market price is key, especially when considering electric vehicles. For a comprehensive look at current pricing, check out this resource on electric car new price to better inform your negotiations and ultimately help you secure a better deal on your new car invoice price.

Comparison of Invoice Prices Across Manufacturers

| Manufacturer | Average Invoice Price (Example – Compact Sedan) | Average Markup Percentage | Notes |

|---|---|---|---|

| Toyota | $20,000 | 3-5% | Known for lower markups. |

| Honda | $21,000 | 4-6% | Similar to Toyota in pricing strategy. |

| Ford | $22,500 | 5-7% | Markups can vary depending on model and demand. |

| BMW | $40,000 | 8-10% | Luxury brands typically have higher markups. |

Locating Invoice Price Information

Several resources can help you find invoice prices, but it’s crucial to understand their limitations and reliability. This section details methods for locating this information and assesses the credibility of different sources.

Methods for Finding Invoice Prices Online

Source: simpleinvoice17.net

Several websites and tools provide estimates of invoice prices. Reputable sources often aggregate data from multiple dealerships and adjust their estimates based on current market conditions. However, remember that these are estimates, not guaranteed prices.

- Utilize automotive pricing websites: Many reputable websites specialize in providing automotive pricing data, including estimates of invoice prices.

- Consult independent automotive publications: Consumer Reports and other automotive publications may offer insights into average transaction prices, which can be helpful in estimating invoice prices.

- Check dealer websites (with caution): Some dealerships may list pricing information on their websites, but this information may not always reflect the actual invoice price.

Reliability of Online Invoice Price Sources

The accuracy of online invoice price data varies. While some sources strive for accuracy, others may provide outdated or incomplete information. It’s best to consult multiple sources to get a more comprehensive picture. Always consider the source’s reputation and track record before relying heavily on its data.

Limitations of Publicly Available Invoice Price Information

Publicly available invoice price information is often an estimate. Actual invoice prices can vary based on several factors, including dealer-specific negotiations with the manufacturer, regional differences in demand, and the specific vehicle configuration.

Step-by-Step Guide for Independent Research

- Identify the specific vehicle model and trim level.

- Use multiple online resources to gather invoice price estimates.

- Compare the estimates to identify a reasonable range.

- Consider factors like optional packages and regional demand.

- Use the information as a starting point for negotiations.

Negotiating with Dealers

Armed with invoice price information, you can approach negotiations from a position of strength. This section provides strategies for effectively communicating your knowledge and countering common dealer objections.

Strategies for Using Invoice Price Information

Use the invoice price as a benchmark, not necessarily your target price. While aiming for a price close to invoice is ideal, be prepared to negotiate slightly higher, considering the dealer’s overhead and desired profit margin. A realistic approach is crucial for a successful negotiation.

Effective Communication of Invoice Price Knowledge

Present your invoice price research calmly and professionally. Avoid confrontational language; instead, frame your knowledge as a helpful tool for a mutually beneficial agreement. Emphasize that you’re aiming for a fair price, not to exploit the dealer.

Comparison of Negotiation Tactics, Find new car invoice price

Several tactics can be used, including starting negotiations below the invoice price (while understanding it may be unrealistic), focusing on the out-the-door price, and leveraging competing offers from other dealerships. The best tactic depends on the specific situation and the dealer’s willingness to negotiate.

Common Dealer Objections and Counterarguments

- Objection: “That invoice price is outdated/incorrect.” Counterargument: “I’ve checked multiple reputable sources; this is the average I’ve found. Can we discuss a fair price based on this data?”

- Objection: “We have to add fees for preparation/documentation.” Counterargument: “While I understand these fees, let’s see if we can adjust the price of the vehicle to offset them.”

- Objection: “This is the lowest price we can offer.” Counterargument: “I appreciate your offer, but I’m looking for a price closer to the invoice price considering my research. Could we compromise?”

Analyzing Pricing Trends: Find New Car Invoice Price

Understanding how invoice prices fluctuate over time can inform your purchasing decisions. This section explores factors affecting these fluctuations and the impact of additional features on the final price.

Factors Affecting Invoice Price Fluctuations

Invoice prices are dynamic, influenced by supply and demand, model year, and economic conditions. For example, new model releases often see higher initial invoice prices, while older models may see reductions as the manufacturer clears inventory. Economic downturns can also lead to lower invoice prices as manufacturers incentivize sales.

Comparison of Invoice Prices Across Dealerships

Invoice prices can vary slightly between dealerships due to factors such as regional demand and dealer-specific negotiations with the manufacturer. It’s beneficial to check invoice price estimates from multiple dealerships in your area to identify the best potential deal.

Visual Representation of Price Variations

A simple bar graph could illustrate the typical price difference between MSRP and invoice price for a given vehicle. The bar representing MSRP would be significantly taller than the bar representing the invoice price, visually showcasing the potential savings by negotiating based on invoice price.

Impact of Optional Packages and Accessories

Adding optional packages and accessories will increase the final invoice price. It’s crucial to factor these additions into your budget and negotiations. Consider the value proposition of each optional feature before committing to purchasing it.

Legal and Ethical Considerations

Source: simpleinvoice17.net

While using invoice price information is legal, ethical considerations are vital for both buyers and sellers. This section discusses the legal and ethical boundaries of using invoice price data in negotiations.

Legality of Using Invoice Price Information

Source: yourcarbuyingadvocate.com

Using invoice price information during negotiations is perfectly legal. It’s a tool to help you make informed decisions and negotiate a fair price. However, misrepresenting or fabricating invoice price information is illegal and unethical.

Ethical Responsibilities of Buyers and Sellers

Buyers should use invoice price information responsibly, avoiding manipulative tactics. Sellers should be transparent about pricing, including all fees and charges. Open and honest communication is key to a fair and ethical transaction.

Examples of Misleading or Deceptive Practices

Presenting a fabricated or significantly inflated invoice price to manipulate the buyer is unethical and potentially illegal. Similarly, concealing fees or misrepresenting the vehicle’s condition are also deceptive practices.

Best Practices for Ethical Car Buying

- Research thoroughly and gather accurate information.

- Be transparent and honest in your negotiations.

- Respect the dealer’s time and effort.

- Avoid manipulative tactics or aggressive bargaining.

- Review all documentation carefully before signing.

Clarifying Questions

What is a dealer holdback?

A dealer holdback is a percentage of the invoice price that the manufacturer retains and pays to the dealership later, often after a certain number of cars are sold. It’s not usually included in the invoice price you see.

How often do invoice prices change?

Invoice prices can fluctuate frequently, influenced by market demand, supply chain issues, and manufacturer incentives. Checking prices regularly is advisable.

Can I negotiate below invoice price?

While negotiating below invoice price is challenging, it’s sometimes possible, particularly if the dealership is motivated to move inventory (e.g., end of month, year, model).

What if the dealer refuses to disclose the invoice price?

While dealers aren’t legally obligated to disclose the invoice price, politely insisting on transparency and referencing your research from reputable sources can sometimes sway them.