New Car Price Breakdown A Comprehensive Guide

Manufacturer’s Suggested Retail Price (MSRP)

New car price breakdown – The Manufacturer’s Suggested Retail Price, or MSRP, is the starting point for understanding a new car’s cost. It’s the price the manufacturer recommends dealers sell the vehicle for. However, the actual price you pay will likely differ due to several factors.

Factors Contributing to MSRP Variations

Several factors influence MSRP variations across different car models. These include the vehicle’s size, features, technology, brand reputation, and manufacturing costs. Luxury vehicles, for instance, command higher MSRPs due to their premium materials, advanced technology, and brand prestige. Fuel efficiency standards and safety ratings also play a role.

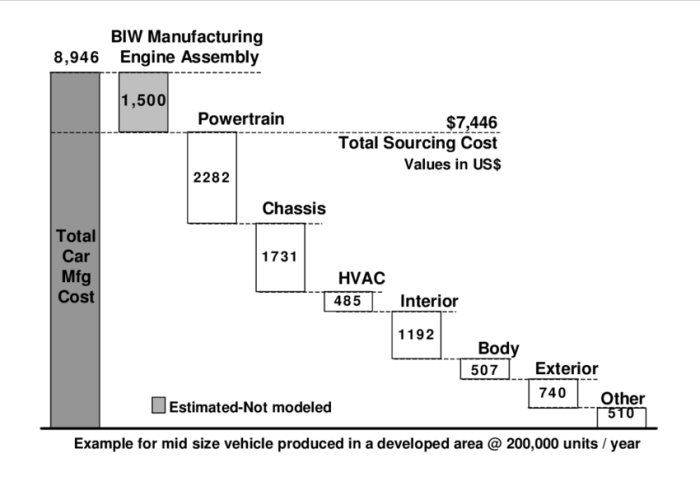

Components Included in the MSRP

The MSRP typically includes the cost of manufacturing, engineering, research and development, marketing, and distribution. It reflects the base price of the vehicle with standard features. Options and packages are usually added on top of the MSRP.

MSRP Determination for Various Vehicle Classes

The MSRP is determined differently for various vehicle classes based on their size, features, and target market. For example, a compact sedan will have a lower MSRP than a full-size SUV due to differences in size, materials, and technology. Trucks, often equipped with more robust engines and capabilities, typically have higher MSRPs than cars.

Average MSRP Range for Popular Car Segments

| Segment | Minimum MSRP | Average MSRP | Maximum MSRP |

|---|---|---|---|

| Compact Sedan | $18,000 | $22,000 | $28,000 |

| Mid-Size SUV | $25,000 | $35,000 | $50,000 |

| Full-Size Truck | $35,000 | $45,000 | $70,000 |

Dealer Markup and Incentives

Dealers play a significant role in setting the final price of a new car. They can adjust prices above or below the MSRP based on market conditions, demand, and their own business strategies.

Dealer Pricing Practices

Dealers might add a markup to the MSRP, especially if the car is in high demand. Conversely, they might offer discounts or incentives to attract buyers, particularly during slow sales periods or to clear out inventory. Negotiation is often key to securing a favorable price.

Manufacturer Incentives

Manufacturers often offer incentives to boost sales, such as rebates, low-interest financing, or lease deals. These incentives can significantly reduce the final price of a car. For example, a $2,000 rebate directly reduces the purchase price.

Dealer Markup Variations

Dealer markups vary significantly depending on location and market demand. In areas with high demand and limited inventory, dealers may be more inclined to add markups. Conversely, areas with lower demand may see more competitive pricing and potentially discounts below MSRP.

Scenario: Final Price with and without Incentives

Let’s consider a car with an MSRP of $25,000. A dealer might add a $1,000 markup, resulting in a price of $26,000. However, if the manufacturer offers a $2,000 rebate, the final price could be $24,000, even lower than the MSRP.

Taxes, Fees, and Registration

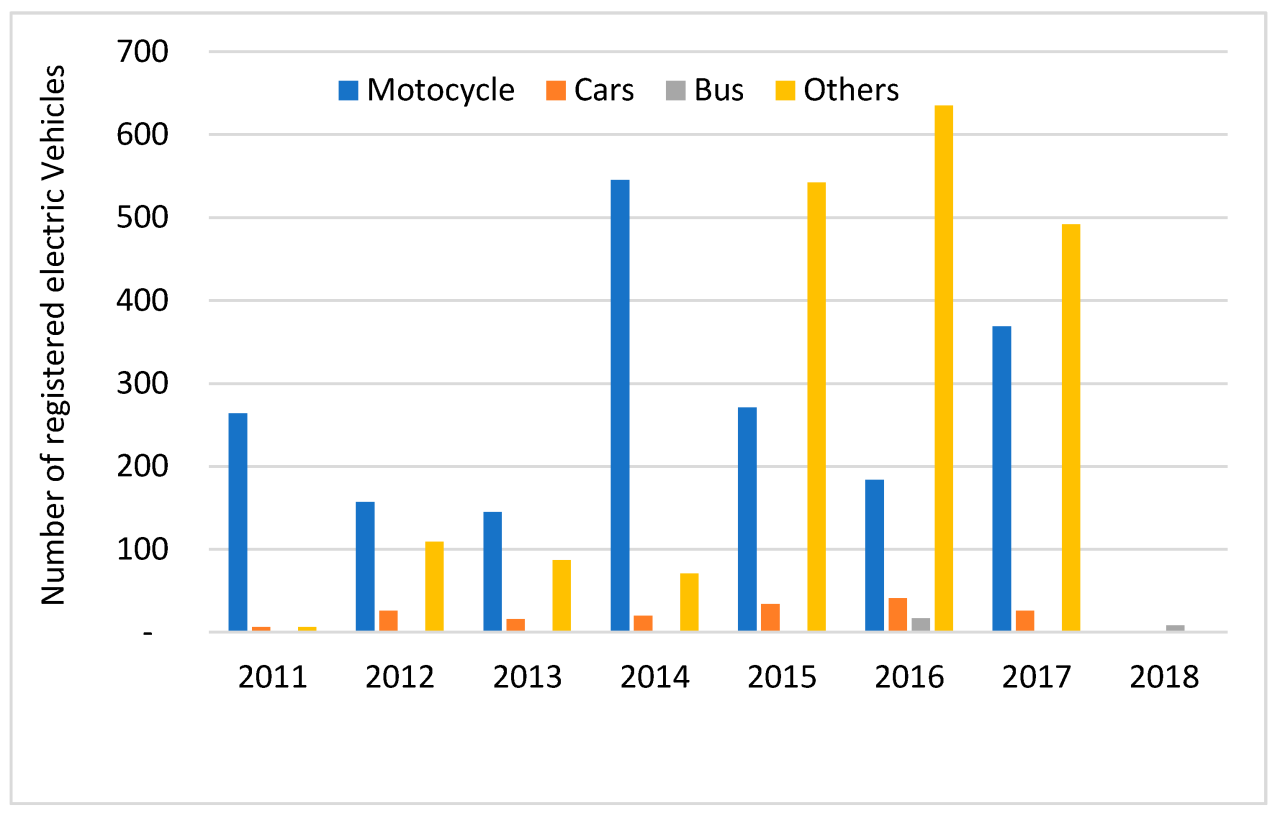

Source: researchgate.net

Beyond the vehicle’s price, several taxes and fees contribute to the total cost of buying a new car. These vary by state and sometimes even by county.

Taxes and Fees Associated with New Car Purchases

Common fees include sales tax (percentage of the purchase price), registration fees (vary by vehicle type and state), title fees (for transferring ownership), and potentially documentary fees charged by the dealership.

State-by-State Comparison of Average Vehicle Registration Fees

- California: $50 – $150 (variable)

- Florida: $225

- Texas: $50 – $70 (variable)

- New York: $100 – $200 (variable)

- Illinois: $150 – $200 (variable)

Note: These are average figures and can vary widely depending on the vehicle’s value and local regulations.

Fee Variations Based on Vehicle Value and Location

Registration fees are typically higher for more expensive vehicles. Location significantly impacts fees; some states have higher taxes and registration costs than others.

Fee Categories and Purposes

Fees can be categorized into governmental fees (taxes, registration, title) and dealership fees (documentary fees). Governmental fees fund state and local services, while dealership fees cover administrative costs.

Financing and Loan Costs

Most car buyers finance their purchases. Understanding loan terms is crucial to managing the total cost.

Total Cost with Different Loan Terms

Longer loan terms result in lower monthly payments but significantly higher total interest paid over the life of the loan. Shorter loan terms mean higher monthly payments but lower overall interest.

Impact of Down Payment Size

A larger down payment reduces the loan amount, leading to lower monthly payments and less total interest paid. A smaller down payment results in higher monthly payments and more interest paid over time.

Types of Auto Loans

Common types include conventional loans from banks or credit unions, dealer financing, and loans from specialized auto finance companies. Interest rates and terms vary depending on the lender and the borrower’s creditworthiness.

Monthly Payments for a $30,000 Car Loan

| Interest Rate | Loan Term (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 4% | 3 | $887 | $2,535 |

| 4% | 5 | $561 | $4,663 |

| 6% | 3 | $916 | $3,214 |

| 6% | 5 | $589 | $5,351 |

Optional Equipment and Packages

Optional equipment and packages significantly impact the final price. Buyers should carefully consider the value proposition of these add-ons.

Impact of Optional Packages

Optional packages bundle features together, often at a discounted price compared to purchasing them individually. However, not all packages offer equal value; some include features buyers may not need or want.

Examples of Optional Features and Costs

Examples include premium sound systems (+$1,000-$3,000), navigation systems (+$500-$1,500), sunroof or moonroof (+$800-$1,500), and advanced driver-assistance systems (ADAS) (+$1,000-$3,000).

Value Proposition of Optional Packages

Evaluate the necessity and value of each feature. Consider whether the added cost justifies the benefit. Research alternative options to avoid overpaying for unnecessary features.

Common Optional Equipment Packages for a Mid-Size Sedan

- Technology Package: Navigation, premium sound, smartphone integration (+$2,500)

- Luxury Package: Leather seats, heated seats, upgraded interior trim (+$3,000)

- Driver Assistance Package: Adaptive cruise control, lane departure warning, automatic emergency braking (+$1,800)

Hidden Costs and Unexpected Expenses

Source: mdpi-res.com

Beyond the upfront costs, several hidden expenses can arise during the first few years of ownership.

Potential Hidden Costs, New car price breakdown

These include extended warranties (can be costly and often unnecessary), paint protection (often overpriced), and dealer-installed accessories (markup can be substantial).

Maintenance Costs During the First Three Years

- Oil changes: $50-$100 per change (every 5,000-7,500 miles)

- Tire rotations and balancing: $50-$75

- Brake pad replacement: $200-$500 (depending on vehicle and wear)

- Other routine maintenance: Varies depending on vehicle and manufacturer recommendations.

Tips for Avoiding Unexpected Expenses

Read the fine print carefully, compare prices from different dealerships and service centers, and prioritize necessary maintenance to avoid costly repairs down the line.

Visual Representation of Price Breakdown: New Car Price Breakdown

Imagine a pie chart. The largest slice represents the MSRP, perhaps 50-60%. A smaller slice, maybe 10-15%, represents dealer markup. Another slice, around 10-15%, represents taxes and fees. Financing costs would constitute a significant slice, potentially 15-20%, depending on the loan terms.

Finally, a smaller slice, 5-10%, would represent optional equipment and packages. The exact proportions would vary based on the specific car, location, and financing options chosen.

Understanding a new car price breakdown can be complex, involving the Manufacturer’s Suggested Retail Price (MSRP), destination charges, and dealer fees. To simplify this process and get a clearer picture of the final cost, you can use a helpful tool like the new car out the door price calculator to estimate your total expenses. This will allow you to better manage your budget when planning your new car purchase, providing a more accurate new car price breakdown.

Top FAQs

What is the difference between MSRP and the sticker price?

MSRP is the manufacturer’s suggested retail price. The sticker price is what the dealer lists, which may include dealer markups or discounts.

How can I negotiate a better price with a dealer?

Research comparable vehicles, know your financing options, and be prepared to walk away if the deal isn’t right. Negotiate the price before discussing financing.

What are some common hidden costs?

Extended warranties, paint protection, and dealer-installed accessories are common hidden costs that can significantly increase the final price.

How long should I expect to finance a new car?

Shorter loan terms typically result in higher monthly payments but less total interest paid over the life of the loan.

What is the best time of year to buy a new car?

The end of the month and quarter, as well as the end of the model year, often offer better deals due to dealer quotas.